Submit your deal and we’ll connect you with lenders fast.

Looking for real estate funding?

We work with a network of trusted lenders to help real estate investors like you get the capital you need. Whether you're flipping a property, building new, or locking in a rental, we’ll review your deal and match it with lenders ready to fund. Just fill out a few quick details and we’ll handle the rest.

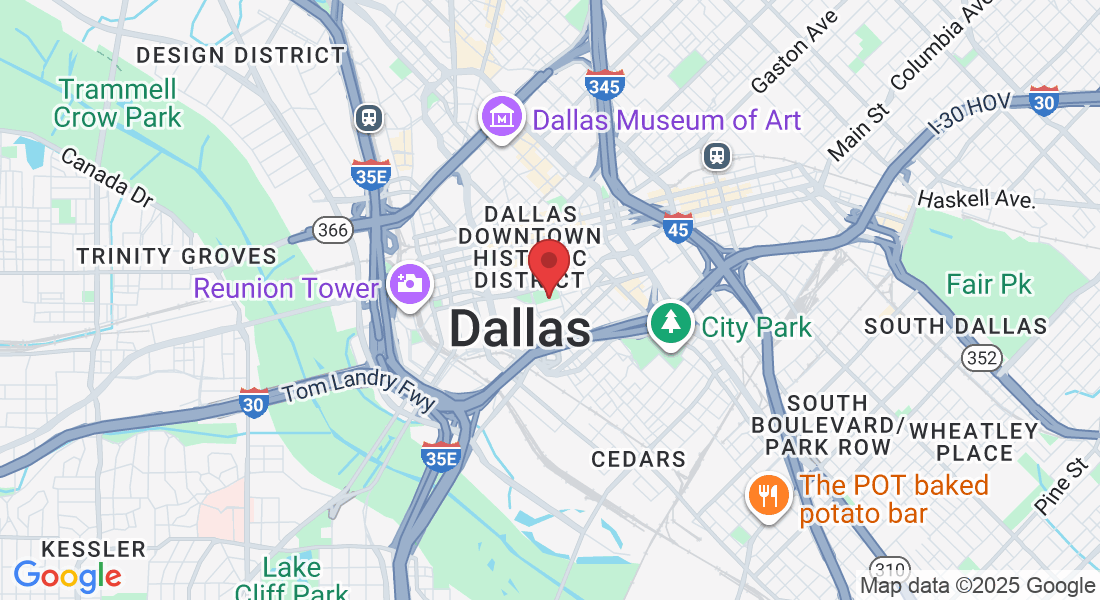

Based in dallas, serving all of texas

At Angelcap, we’re committed to helping real estate investors get the funding they need — quickly and reliably. We work with a trusted network of private and hard money lenders who understand your goals and move at your pace. Whether you're flipping, building, or scaling your portfolio, we’ll guide your deal through the process and help you secure the right loan. With responsive support, competitive terms, and a streamlined submission experience, you're in good hands from start to close.

Fast Approval Process – Get matched quickly and receive funding faster — helping you move forward with your real estate project without delays.

Tailored Lending Plans – We connect you with lenders offering loan terms built around your project — whether you're flipping, building, or holding long-term. Get funding that fits your investment strategy.

Flexible Loan Structures – Choose from lender terms that fit your exit strategy — with interest-only options, no prepayment penalties, and project-friendly timelines.

Competitive Interest Rates – We connect you with lenders offering competitive rates and terms — so you can fund your next deal without overpaying.

Dedicated Support – Our team of experts is available to guide you every step of the way, offering personalized assistance to ensure a smooth lending experience.

Frequently Asked Questions

What types of loans do you offer, and how do I know which one is right for me?

We specialize in real estate investment loans, including fix and flip, new construction, rental (DSCR), and bridge loans. Each is designed to support different strategies and exit plans. After you submit your deal, our team reviews your project and recommends funding options from our network of private and hard money lenders. Whether you're flipping your first property or scaling a rental portfolio, we’ll help you find the right loan for your goals.

How quickly can I get approved for a loan, and what is the process like?

Our process is built for speed and simplicity. After you submit your project through our short intake form, we’ll collaborate with you to gather the key information needed to build a strong credibility packet. Once you send us the necessary details, we’ll organize and prepare your packet to present to lenders. From there, our CEO will personally connect you with private or hard money lenders who are a fit for your deal. Most clients close in 2 to 3 weeks, and those with repeat deals may close in as little as 10 days. We keep you informed every step of the way to ensure a smooth experience from start to close.

What are the eligibility criteria for obtaining a loan from your platform?

Eligibility depends on your project type and the specific loan you’re seeking. Generally, lenders look at the property’s value, your investment experience, your exit strategy, and how much capital you’re bringing to the table. Some programs have more flexible terms, while others may require stronger experience or equity. For a detailed breakdown, view our deal criteria, or reach out and we’ll guide you based on your situation.

How do your interest rates compare to other lending institutions, and are they fixed or variable?

We pride ourselves on offering competitive interest rates that are often lower than those available from other lenders. Our rates are transparent, and whether fixed or variable, we make sure you fully understand the terms before proceeding. Fixed rates provide stability, ensuring your payments remain consistent throughout the term of the loan, while variable rates can offer flexibility, adjusting to market conditions as needed. Our team will help you determine which option suits your financial situation best.

Can I repay my loan early without facing penalties?

Yes. At AngelCap, we believe in giving our clients the flexibility to succeed on their terms. You’re free to repay your loan early without any prepayment penalties. Whether your financials improve or you simply want to close out the loan sooner, you can do so without incurring any additional fees. Early payoff can help reduce your overall interest costs—and we fully support it as a smart move.

How do I apply for a loan, and what documents do I need to provide?

Applying with AngelCap is simple. To get started, just fill out our Loan Request Form. It walks you through a few key questions about your project—such as the purchase price, rehab budget, property details, exit strategy, and more.

Once submitted, our team will follow up with you to co-create a Credibility Packet—a clean, organized presentation of your deal that we share with our network of private and hard money lenders. You’ll just need to provide documents like:

• A signed purchase & sale agreement

• Rehab scope & cost estimates

• Credit score and ID

• Details about your experience and exit strategy

From there, our CEO will personally match you with lenders who are a fit. The more accurate your form, the faster we can move.

What happens if I miss a payment, and what options do I have if I’m struggling to make payments?

At AngelCap, we understand that unexpected challenges can arise. While repayment terms are ultimately set by the lender funding your deal, we're here to help you communicate and explore solutions early.

If you anticipate difficulty making a payment, it’s crucial to reach out as soon as possible. Many lenders offer options such as payment deferment, interest-only periods, or loan restructuring depending on the situation and loan type.

Our team is here to support you in navigating those conversations. We aim to match you with funding partners who value flexibility, and we’re committed to helping you protect your investment through whatever comes your way.

Testimonials

From intake to closing, the AngelCap team moved quickly and communicated clearly. I closed in just under two weeks, and I’m already lining up my next project with their help. It’s rare to find a funding partner that’s both efficient and genuinely invested in your success.

Aidan Harper - Dallas, TX

I was hesitant about hard money, but AngelCap earned my trust. They built a credibility packet for my deal, pitched it to vetted lenders, and got me funded without the usual runaround. Their process gave me the confidence to take on a bigger deal than I would have on my own.

Sophie Alvarez - Houston, TX

Come, See What’s Waiting!

Get In Touch

Hours

Mon – Sat: 8:00am – 6:00pm

Sunday – CLOSED

Shop: 410 N Jefferson Ave., Suite 398

Mount Pleasant, TX 75455

Call: (972) 850-2050

Email: [email protected]

Site: https://www.angelcap.co